Table of Content

Based on the analysis, we help you discover loans and credit cards best suited for your credit profile. We help you understand your Credit Profile, Credit Information Report and know where you stand. We ensure that you have a better shot at getting an approval for a loan or credit card you apply since we match the lender’s criteria to your credit profile. We help you avoid loan rejection by carefully determining your eligibility and matching you with the right lender/product.

LoanTap provides personal loans to its customers via an online platform, and the loan balance is issued through an internal non-banking finance organisation . Although the borrower is not requested to offer any security or a third-party insurer, in certain cases, the borrower may be asked to do so. In today’s scenario most home loan applicant goes for joint applications to reduce the burden of EMI. Even though taking a joint home loan has its own advantage it can also be a cause for the application to be rejected if your co-borrower’s credit score is low.

Why Apply for a Home Loan with HDFC

HDFC Bank also facilitates legal or technical help on home loans to avoid any discrepancies in the future. The applicant seeking advice is liable to pay fees as demanded by the expert, exclusive of the loan amount. The cost of a home can often go north, rendering the already availed home loan amount insufficient. Hence, existing customers can further go for a top-up loan of up to Rs 50 lakh. However, the approval of your loan depends on your repayment capacity. It is up to HDFC to assess your eligibility and ability to repay the EMIs for two home loans.

Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case.

Home Loan Recommended Articles

This is the primary home loan offered by the bank to purchase a new property, resale property, or construct a new home. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement. Post the fixed rate tenure, the loan switches to an adjustable rate.

We achieve this with a cutting edge combination of data science and technology that ensures that both lenders and borrowers have a transparent common platform to make their decisions. We treat your data with the utmost confidentiality and will never share or sell it to anyone. Our dedicated and best-in-class customer service will go the extra mile to support you on every step of your credit journey. Generally, bank’s representative will come to your place of work or your home to collect the filled in application form and all the necessary documents required for verification at any time you specify. After passing through document verification and eligibility criteria, the approval process moves to the final level. At the final stage and after negotiations, the HDFC Bank home loan interest rate and tenure are fixed and sent for your acknowledgement.

HDFC Home Loan Eligibility Criteria

It will redirect the website containing the loan calculator to you. Scheduling for a company representative to visit at a suitable time. The borrower must be a salaried worker with a reputable company.

If your credit score or income is low and you require a higher loan amount, it is wise to apply for a Home Loan with a co-applicant. Home loans being a high value investment, also means that the EMI each month will be high. If an applicant already has debts that need to be repaid, then the loan application might be rejected. In case your home loan application was rejected you will receive HDFC Bank loan rejection letter which will receive a status update on the home loan rejection.

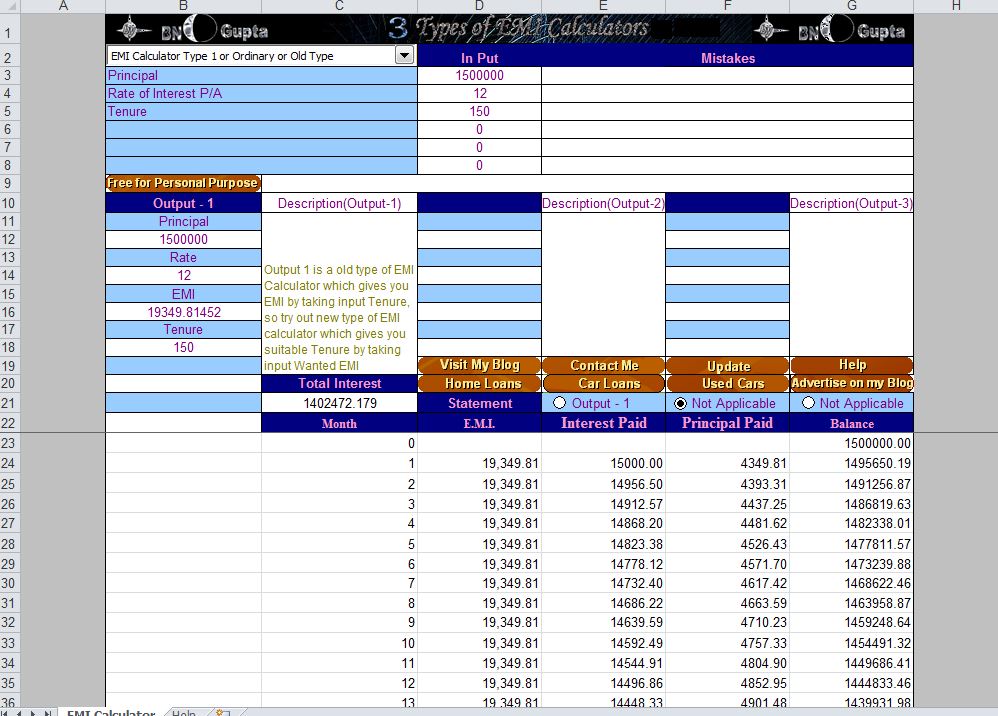

Loan Amount – This amount borrowed from HDFC for a home loan by a borrower affects his home loan EMI. With HDFC, you can get a home loan for a minimum of Rs. 5 lakhs up to Rs. 5 crores. It will also show the total amount paid towards the principal, the interest amount charged, and the total amount payable towards the loan. Make sure you provide all the details that the home loan provider will need to process your application. Complete the application form online with the necessary information.

You can follow the tips given below to improve your eligibility for a home loan. Specifications which the underlying property such as age of the property, its size, etc. Click ‘View Application’ below the one whose status you wish to check. 3) Enter your name, user ID, mobile number and other required details to sign up. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums.

Public receiving such phone calls are requested to lodge a police complaint. Headquartered in Mumbai, HDFC Sales was formed in January 2004. Today, after 17 years, it is a workforce of 10,000+ employees in over 350 branches across various locations in India. At HDFC Sales, our clients are at the heart of all our endeavours.

In case you would like us to get in touch with you, kindly leave your details with us. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. Once you get an indication of your eligibility and EMI amount by using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC. As a precaution it is best to verify all the documents and property details before purchasing.

The consent herein shall override any registration for DNC/NDNC. CreditMantri is India’s No. 1 site for Credit Analysis and Free Credit Score Online. Let us help you take control of your credit goals and unlock the door to your financial freedom. The interest rate value starts from above 5% and the maximum interest rate value is 15%. Similarly, if there are any discrepancies like your date of birth is different from what is on your application then it is grounds for rejection of Home loan.

Home Loan EMI is the monthly repayment that a borrower should make to repay the home loan as per the amortization schedule. HSPL and HSPL authorized recruitment agents/ agencies do not ask for payments from applicants at any point in the recruitment process. You might be working in a company which is not in the list of approved employers by banks. In such cases the banks feel that your job is not secure and not reliable to pay back the loan amount. Look into banks/NBFC that have your company listed to make sure that your application is not rejected and get good terms on your loan.